The Beginner’s Guide to Bookkeeping

Content

Bookkeeping is the backbone of your accounting and financial systems, and can impact the growth and success of your small business. It encompasses a variety of day-to-day tasks, including basic data entry, categorizing transactions, managing accounts receivable and running payroll. You should also hold onto the proof of purchase if you plan to claim that expense as a tax deduction.

If you’re just starting a bookkeeping business, it’s likely that you’ll just be working solo, at least for the beginning. Consider starting your search into business entities for bookkeepers by looking into sole proprietors and LLCs. The latter could be a great option if you might bring in some help down the line.

Server Inventory Checklist

If you outsource your accounting function, bookkeeping and payroll can usually be included as part of the service. Having a comprehensive finance function can put your mind at rest, save you time, and enable your business to grow as fast as you want it to. Keep in mind, though, bookkeepers differ from accountants as they cannot file taxes or perform audits https://adprun.net/intuit-bookkeeping-expert-careers-remote/ like certified public accountants. While they can receive certifications through training programs, they can also simply acquire on-the-job experience to establish their bookkeeping business. Once your bank accounts have been reconciled and any adjustments made in your recording tool of choice, you’ll want to close the month and print financial statements.

- It all begins with getting your accounting software set up correctly.

- If you’ve accurately kept track of and reported your employees’ salaries and wages, you can claim them with the Employee Retention Credit.

- DIY bookkeeping can help save you money and ensure you stay on the pulse of your finances.

- This accounting method presumes that your most recent (last in) products will be the first to sell (first out).

- You’ll learn which accounting methods to choose, how to track expenses, and muchmore.

This payroll processing solution is ideal for small business teams with a greater number of members or growing teams looking for a system to expand with them. With an employee self-service platform and workforce planning, the system makes it easy for administrators Certified Bookkeeper Certifications & Licenses CPB and CB and team members to manage payment processes. These tasks used to be managed using books and ledgers, hence the name « bookkeeping ». Originally the transactions would be recorded in daybooks, cashbooks, or journals and then transferred to a ledger.

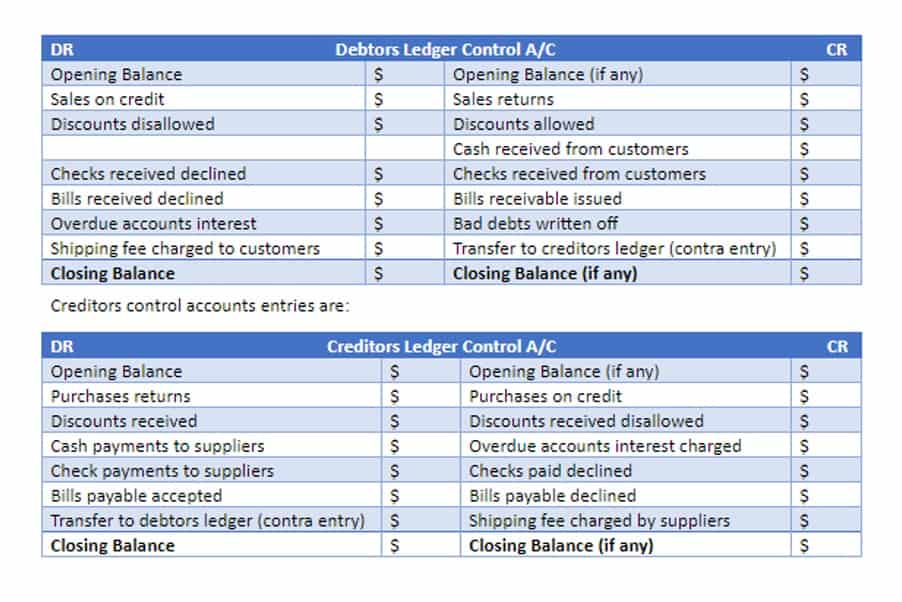

Reconciling Your Accounts

Making sure transactions are properly assigned to accounts gives you the best view of your business and helps you extract the most helpful reports from your bookkeeping software. Another type of accounting method is the accrual-based accounting method. This method records both invoices and bills even if they haven’t been paid yet. This is a highly recommended method because it tells the company’s financial status based on known incoming and outgoing funds.