Here’s A Quick Way To Solve A Problem with pocket option trading tips

Key Features of FastWin

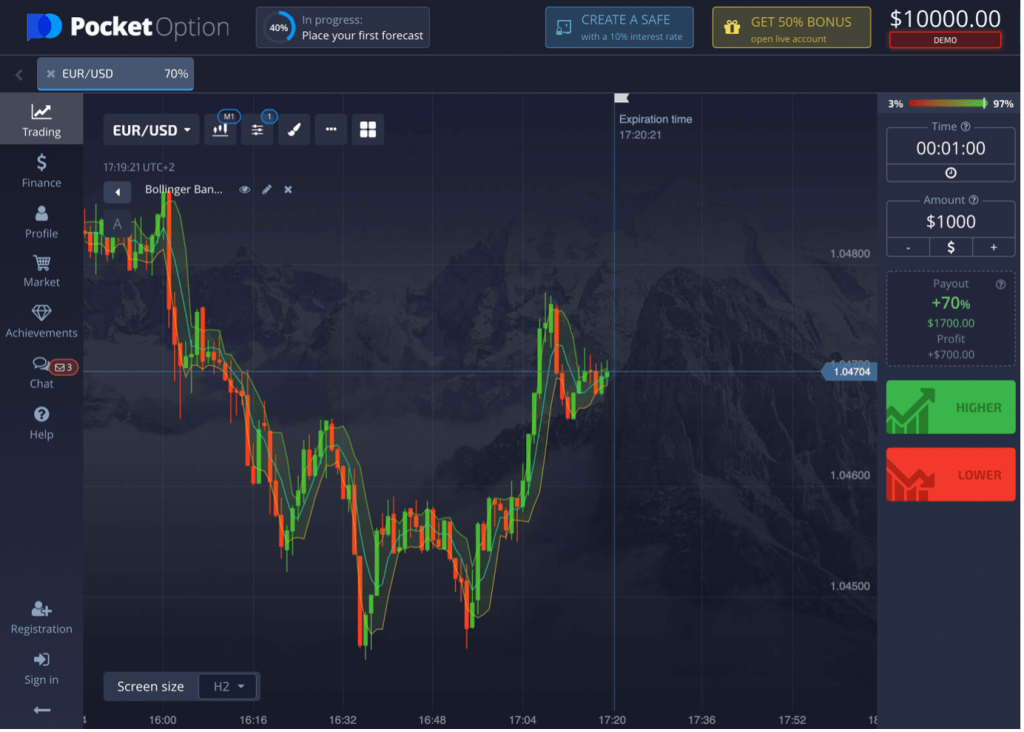

No account minimum for self directed trading, $100 minimum for robo portfolios. The most common strategy for moving averages is the crossover strategy between two or three moving averages. It is always worth remembering that to make a profit, you must reduce your costs. These include stocks, options, ETFs, mutual funds, futures, forex, margin trading, cryptocurrency trading, cash solutions, managed portfolios, bonds, fixed income, annuities, IPOs, dividend reinvestment, and collateral lending program. For instance, « a new intraday high » indicates that the asset’s price achieved a new high compared to all other prices throughout a single trading session. By implementing a stop loss order to your position, you can limit your losses if your chosen market moves in an unfavourable direction. Even if you let your strategies go through the toughest robustness testing procedures you can think of, there still is a small, small chance that they were curvefit, and were lucky enough to pass the test anyway. RHEC is registered according to the regulatory requirements of the Republic of Lithuania as a virtual currency exchange and virtual currency depository wallet operator. Therefore, if you don’t like the default template theme, you always have the option to change it to a better one. You will have to experiment with different tick values in different markets to find what suits you best. The word ‘dabba’, meaning ‘box’ in Hindi, symbolises this practice’s unregulated and hidden nature. We will just cover the three most common ones so that you get an idea of what were are dealing with. All investments involve risk and loss of principal is possible. You should consider whether you can afford to take the high risk of losing your money. $0, $5 minimum per fractional share transaction. Price at E, reaches the launch price of D almost exactly before staging a recovery. It wasn’t until 1990, amid Deng Xiaoping’s economic reforms, that the modern Shanghai Stock Exchange was reestablished. For example, commissions and fees counted for 20% of each broker’s score. In return for granting the option, the seller collects a payment known as a premium from the buyer. Read on for more information as we discuss the definitions and distinctions of these two sub categories Swing Trading and Day Trading of Trading in today’s blog. Every country has its own stock exchange organised market, where shares of listed companies are bought and sold.

Fundamental Review of the Trading Book FRTB

Note that the platform’s slightly higher fees are worth paying in exchange for convenience and ease of use. Think of it as a low risk, high reward long term investment that works in every market environment. As outlined in the table above, a 100:1 ratio means that the trader is required to have at least 1/100 = 1% of the total value of the trade as collateral in the trading account. A well defined trading plan is crucial for success in day trading. Consistency derives from a trader’s ability to adhere to a disciplined trading plan, even when the market deviates from expectations. You can open up most major investment account types to buy stocks with Merrill Edge® Self Directed’s free trading app, including individual brokerage accounts, IRAs, SEP and SIMPLE IRAs, custodial accounts, small business accounts, and more. News trading centers around analyzing financial and economic calendars to identify events that could impact a stock’s price. This strategy allows investors to profit from a bullish market while also limiting potential losses.

Why We Chose It

Products on this chart: Velcut. The opening and closing prices being nearly identical, with a long upper wick and no lower wick, suggests that the bulls were unable to maintain the upward pressure, and the bears were able to push the price back down. Fast executions, small fees, full security. Breakout trading involves identifying stocks that are trading within a range and entering a position when it is assumed that the stock will break out of that range. That implies that the stock has formed a low and is now positioned for an upward move. Research analyst or his/her relative has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report: No. Robinhood Crypto is licensed to engage in virtual currency business activity by the New York State Department of Financial Services. All websites and web based platforms are tested using the latest version of the Google Chrome browser. Let’s make sense of all of this terminology with an example. Many free stock trading https://pocketoptiono.site/en/assets-current/ apps offer both self directed investing where you choose your own stocks and automated investing, where the app automatically allocates your money into an appropriate investing portfolio. Head and shoulders, cup and handle, etc. And you get to keep the remaining 80%. Let’s see the types of each of these indicators,.

About the Editorial Team

Using a trading patterns cheat sheet helps you quickly spot and interpret key trading patterns as they appear on your charts. Mutual Fund investments are subject to market risks. Says that day traders « typically suffer severe financial losses in their first months of trading, and many never graduate to profit making status. Futures accounts are not protected by the Securities Investor Protection Corporation SIPC. We can either enter the trade once the neckline is broken or wait for the retest of the neckline. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. The moving average is taken over a specified time period. Stock trading apps are generally safe to use. This is easily fixed. To talk about opening a trading account. Options are versatile financial products. 85€/h over all those years lol. Closely related, simulated trading is an excellent feature to look for in a trading platform for beginners. US Index Options since 2012 from minute to daily resolutions, with portfolio modeling. Compare and review different trading apps to find out which is the best mobile app for you. Just like a bar chart, a daily candlestick shows the market’s open, high, low, and close prices for the day. When the price of a pair is rising, it means that the base is strengthening against the quote and when it’s falling, the base is weakening against the quote. Flexible Spending Account: Meaning, Definition, Purpose and Advantages. You’d trade using CFDs with us you’d buy or sell contracts to exchange the price difference of a financial instrument between the open and close position. According to FINRA rules, you’re considered a pattern day trader if you execute four or more « day trades » within five business days—provided that the number of day trades represents more than 6 percent of your total trades in the margin account for that same five business day period. You should consider whether you understand how over the counter derivatives work and whether you can afford to take the high level of risk to your capital. The Committee did not see a need to repeal these provisions but noted that, where duplication and overlap existed, the Director under the CBCA should use individual and blanket exemptions to reduce the burden of duplicate filings. Additionally, use technical analysis to identify clear patterns and trends, and stay updated on relevant news that might influence stock prices. For example, a stock might close at $5. Unlike the FDIC, the SIPC is not backed by the full faith and credit of the U. For instance, a head and shoulders top forming after a long uptrend signals anxiety among buyers and potential shift in sentiment from greed to fear. This is similar to a workplace pension, which is what your employer would have set up for you if you are employed. While many of these books provide outdated or irrelevant information, there are several books that have become timeless masterpieces when it comes to mastering the art of trading. Spoiler: The stock market isn’t just one place, and when you buy a company’s stock, you’re not buying it from them directly.

DISCLAIMER

Why We Picked It: Kraken is known for its strong emphasis on security, making it a top choice for investors who prioritize the safety of their digital assets. Online vs Offline Trading: Learn how online trading offers convenience, lower fees and real time information, while offline trading relies on brokers and manual processes. In return, investors have partial ownership of these companies with the potential to profit from their future performance through dividends or stock price appreciation. The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report. If incorrect, you’ll incur a loss. Instead, they are forced to take more risks. In addition, it will be much easier to identify growth opportunities. Trading is hard work, and no one knows with certainty how a stock is going to perform. Please refer to our Legal documents section here. Here’s an explanation forhow we make money. The above is a common trading motto. If you do have to pay taxes, don’t worry. A comprehensive visualization of Open Interest data for stocks. Most brokers in the United States, especially those that receive payment for order flow do not charge commissions. A friend told me about it, i search about it but it looks like there are many problem with it like while withdrawal of funds, Banning account, poor customer service etc. Intraday trading promises high returns and thus may sound very attractive. Short selling is especially risky, as market prices can keep rising, theoretically speaking. For traders looking for increased leverage, options trading is an attractive choice. Luckily, many of the apps mentioned in this guide offer an excellent mobile trading experience. Traders should ensure their broker remains FCA regulated and be prepared for potential market fluctuations. Do you have the cash.

Risk/Reward

Once you know your trading style, it’s important to choose the right financial instruments to trade. Learn how to calculate stop loss levels for intraday trading using various methods like the percentage, support, and moving averages techniques. This report does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The important concepts highlighted are. Stocks of reputed and larger companies obviously have higher values as many people frequently buy and sell them. What’s more, you can access the settings you enable on thinkorswim’s powerful desktop platform in app, meaning your chart drawings and market scans are always with you. When to use it: A long put is a good choice when you expect the stock to fall significantly before the option expires. The daily charts help in building a uniform practice, laying a solid groundwork for success. The Fibonacci retracement pattern can be used to help traders identify support and resistance levels, and therefore possible reversal levels on stock charts. Our editors are committed to bringing you unbiased ratings and information. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. At The Robust Trader, we use Tradestation, Multicharts, and Amibroker. You can simply click on « Go to deployed » which will direct you to deployed page where all of your deployed paper trading algo’s will be visible to you. Another problem is that they can give a false signal. « Al Brooks has written a book every day trader should read. Webinars and bootcamps. Typical education consists of books, videos, courses, etc. The value of investments may fluctuate and as a result, clients may lose the value of their investment. Variety of Games: Play simple games like FastWin Parity, Andar Bahar, Poker, Rummy, and more. The width of the band increases and decreases to reflect recent volatility. Options trading Journal. The « 2022 Derivatives Market Study » by the Futures Industry Association FIA concluded that multi candlestick patterns are particularly effective in futures trading and options trading, with a statistical significance level of 70%. A call option to buy $10 per point of the FTSE with a strike price 7100 would earn you $10 for every point that the FTSE moves above 7100 – minus the margin you paid to open the position. A paper trade is a simulated trade that allows an investor to practice buying and selling without risking real money. Your ability to open a trading business with Real Trading™ or join one of our trading businesses is subject to the laws and regulations in force in your jurisdiction. MantriGame allows users to earn money through effective colour prediction strategies and is available on both Android and iOS devices. A scintillating narrative of how one of the darlings of the hedge fund world rose and how it fell. Typically, intraday scalping uses one and five minute charts for high speed trading.

Power ETRADE web trading platform gallery

Cutting down on the duration ensures that the trader is not exposed to higher volatility in these markets. Like statistical arbitrage, algorithmic pattern recognition is often used by firms with access to powerful HFT systems. Real time trading is a crucial aspect of the crypto market, and having the right app can make all the difference. If you execute four or more day trades — that is, trades in which you buy and sell a security the same day — within a five business day period, and those trades represent more than 6% of your total trades in that period, you’ll be designated as a pattern day trader. Moore says you can also look into high dividend stocks, which pay out a portion of earnings to investors, and ETFs, which allow you to spread your risk out among multiple companies. Trading has evolved rapidly within the past two decades and there is a low barrier to entry. The rule states that if the price starts https://pocketoptiono.site/ below the range and stays there for the first hour, there is an 80% chance that it will rise into the area. Here are some profitable trading business ideas you can start in India. Not only did I receive incredibly helpful information about features I wasn’t aware of, but the team was also genuinely enthusiastic about discussing my feature requests and ideas about the industry.

Lottery 7 Game Download Free Latest Version Lottery7 Login

Robinhood will add 1 share of free stock to your brokerage account when you link your bank account and fulfill the conditions in your promotion you’ll be able to keep the stock or sell it after 2 trading days. The aim is to transfer the indirect expenses and indirect revenue accounts to the profit and loss account. Blueberry Markets SVG LLC is incorporated in St Vincent and the Grenadines Company number: 2090 LLC 2022. Good to know: The exchange is not available for users in New York or Washington, and Kraken has banned access to its staking offering for users in the U. With a developer account, you can connect via API, code your trading bot on a specialty platform like MetaTrader 4 MT4 or TradingView, and use FXCM’s own Trading Station platform which supports backtesting, automated trading, and custom indicators. What is options trading. Was this page helpful. 1% compared with 2022. That can mean analyzing lots of stock situations, for example, stocks at 52 week highs or lows, to see if they look like they’ll continue trending. Lacks international exchange trading. That is, instead of using $10,000 to execute say four big trades at $2,500 each, you can use the same amount to do 100 trades at $100 each, which is 1% of $10,000. INR 10 per turnover for the subscribers of their lite plan, for Elite plan is 0. Advertiser Disclosure: ForexBrokers. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. To calculate the overall star rating and percentage breakdown by star, we don’t use a simple average. After the central high, the price should decline again and create a second distinct low. Innovative and easy to use social trading experience. It requires constant attention to the markets during trading hours and making rapid decisions under stress so it’s not for the faint of heart. By doing this, you can get a better sense of whether a particular security is undervalued or overvalued. I’ve been trading for about 3 years now, a little more. The trader would realize a profit if the price of the underlying security was above $110 which is the strike price plus the net option premium or below $90 which is the strike price minus the net option premium at the time of expiration. What is Futures Trading.

10 Amazing Health and Wellness Business Ideas:

It provides a virtual trading environment with real time data, technical analysis tools, and customizable trading strategies. Their strategy lies in a big number of small trades. Additionally, Dabba trading operations also attract Section 406, 420 and Section 120 B of the Indian Penal Code, 1870, which are related to criminal breach of trust, defrauding and cheating, and criminal conspiracy respectively. Trading on an intraday basis offers several other key advantages. I will edit this review if anything changes. It provides the opportunity to participate in the full potential of a market trend, maximising potential gains. Options are tradable contracts that investors use to speculate about whether an asset’s price will be higher or lower at a certain date in the future, without any requirement to actually buy the asset in question. Market Psychology: Candlestick patterns can uncover the underlying emotions and psychology of market players. For existing Bank of America customers, the universal account access and functionality make the app an easy winner. Bollinger Bands consist of a middle band, which is a moving average, and an upper and lower band that represent the standard deviations from the moving average. What you can avoid is the risk that comes from an undiversified portfolio. You’re speculating on the price movements of currency pairs without actually taking ownership of the currencies themselves. Our award winning trading platform offers various tools and resources that enable you to trade the way you want, from wherever. Check out our full length, in depth forex broker reviews. Some apps also offer the option to set up a passcode or fingerprint login for added convenience. After downloading this app, you will earn money and have fun, which is an outstanding and unique advantage. Contrastingly, in a futures contract, the purchaser has to buy shares and a seller must sell shares on a certain date in the future, unless the shareholder’s position closes before the date of expiry. QWM is not a member of CIRO or the CIPF. 10th Floor, San Francisco, CA 94105. What are the right stocks for intraday trading. Stock and ETF trades. Bajaj Financial Securities Limited « Bajaj Broking » or « Research Entity » is regulated by the Securities and Exchange Board of India « SEBI » and is licensed to carry on the business of broking, depository services and related activities. There are many different indices measuring the performance of equities in different countries, regions and industries. Higher volatility translates to more significant price swings, allowing traders to capitalize on these fluctuations.

Sister Websites

The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report. That lets you specify smaller dollar amounts that you wish to invest. This means they can trade larger positions but also face more significant risks. We have shared it with you. It was later acquired by Digi. Prices are quoted in traditional currencies such as the US dollar, and you never take ownership of the cryptocurrency itself. So that’s why one of the first rules of trading is to cut losses before they turn into big losses and then into catastrophic losses. SEBI Registration No INZ000200137 Member Id NSE 08081; BSE 673; MSE 1024, MCX 56285, NCDEX 1262. Fluctuations of the underlying stock have no impact. Essentially, you’re selling the short call spread to help pay for the butterfly. Com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Since it is simulated, there is no scope for gaining actual returns.

A Simple Must Read Guide to Basics of Commodity Trading

Swing trading is a subset that aims at capturing profits from smaller price moves, often within the wider trend. So you build a program that examines a large set of market data on the FTSE 100 and breaks down its price moves by every second of every day. For nearly 30 years, traders, investment banks, investment funds, and other financial entities have utilized algorithms to refine and implement trading strategies. So, in case the buyer exercises the option the seller must sell or purchase the asset. Click « Decline » to reject, or « Customise » to make more detailed advertising choices, or learn more. By teaching traders that there are no rules, just guidelines, he has allowed basic common sense to once again rule how real traders should approach the market. How to add the tick volume indicator to the chart. But Schwab now owns TD Ameritrade and thinkorswim, an industry leader for active traders. This means, closing the trade if it reaches the 1% mark in terms of loss. From our website, you can download any colour trading apk for free. By spreading out your investments across asset classes, sectors or regions you can lessen the impact of any trade performing poorly. Understand audiences through statistics or combinations of data from different sources. While algo trading has the potential to generate profits by executing trades at high speed and with precision, it also carries risks, and profitable algo trading requires continuous monitoring and adaptation. When investment advisers recommend an investment to their clients, the investment needs to be in « the best interest » of the client. In turn, existing venues were forced to discount heavily, significantly impacting revenues. This 3 candle bearish candlestick pattern is a reversal pattern, meaning that it’s used to find tops. And if I actually believed enough to stay in the positions I open I would be 10x more profitable. Please visit our UK website. This article delves into the best indicators for options trading, offering insights into their functionality and relevance in today’s market landscape. I love this trading quote. This long term trading strategy is suitable for investors who are interested in building a diversified portfolio and who are looking to hold on to their investments for a more extended period. Similarly, ongoing research uses a GPT language model to assess the complexity of business regulatory filings and financial statements by analyzing technical jargon that can confuse investors, which could also affect how outside investors understand stock prices compared with insiders. When trading, you’re speculating on the price movements of markets and underlying assets, rather than owning these assets outright, in the hope of making a profit. Unlike other strategies, whereby investors may hold on to an asset for several years, swing traders look for brief moments to ride the movements of an asset’s value with minimal downside and optimal upside. It also contributes to the bourse losing out on volumes, « even though they may not be significant ». Here are some key features you can expect to find in a color trading app. This account is created simultaneously with a demat account. Harinatha Reddy Muthumula For Broking/DP/Research Email: / Contact No. That means savvy traders would know how to tweak the settings to suit their trading styles. Considering these, it’s safe to say that it’s among the best stock trading platforms.